what do you need to open a chase checking account

Chime is a financial technology visitor, non a bank. Banking services provided by The Bancorp Banking company or Pace Banking concern Northward.A.; Members FDIC

Chinkle is a financial engineering science company, non a bank. Banking services provided by, and debit card issued by, The Bancorp Banking concern or Step Bank, N.A.; Members FDIC.

A big international banking concern like Chase gives customers access to a huge network of ATMs and branches nigh anywhere, withal, it as well typicallycharges fees for its accounts. These charges include Chase overdraft fees, monthly services fees, checking account fees, wire transfer fees and ATM fees for using a non-Chase machine. Chase banking company does as well offer upwardly to date options for mobile and online banking.

Banking with Fee-Free Overdraft

✓ Overdraft upwards to $100 with no overdraft fees

✓No hidden bank fees

✓Grow your savings automatically

Signing up is gratis and takes less than ii minutes.

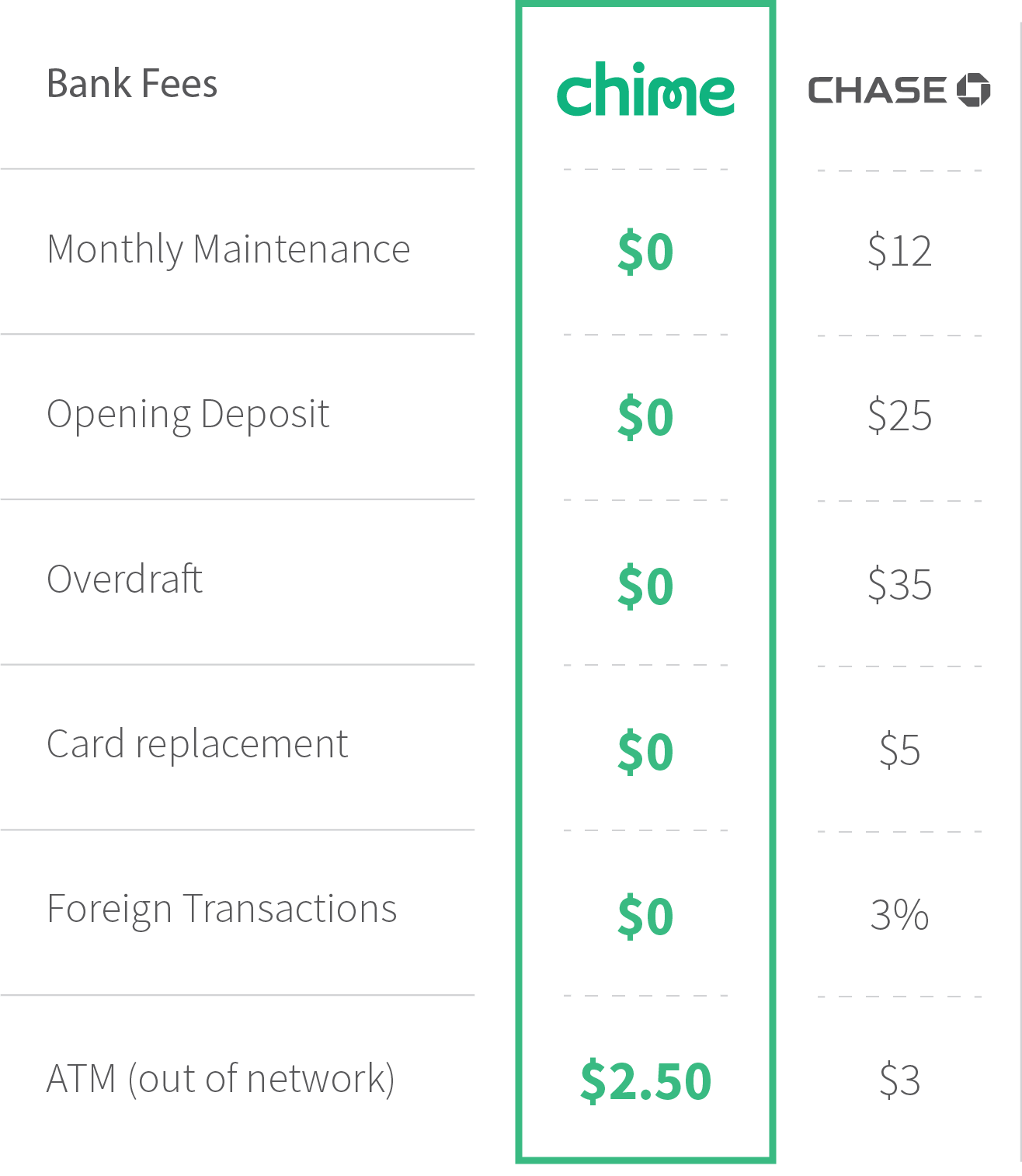

The minimum deposit for a Chase banking company account depends on what type of business relationship that you want to open. Chase bank offers three types of checking accounts: Chase Premier Plus Checking, Chase Full Checking and Chase Premier Platinum Checking. All 3 of these types of accounts take a monthly maintenance fee. The most significant departure between the three types of Chase checking accounts is that Chase Premier Plus accounts, both the regular and Platinum accounts, pay interest but Hunt Total Checking does not.

Chase Total Checking is a basic checking account. The monthly service fee for a Total Checking account is $12, but in that location are ways that you can get that service fee waived. Total Checking requires a minimum deposit of $25 to open an account. That $12 fee is cutting in half for students currently enrolled in high school or higher. Total Checking account holders pay no Chase ATM fees at whatever in-network ATM and deposits can exist fabricated at in-network ATMs also. Total Checking business relationship holders as well have full and free access to Chase'south online banking and online bill paying features.

For people who want to earn interest on their money, in that location is the Chase Premier Plus checking account. This account has a higher service fee of $25 per calendar month. The current interest rate paid on the rest of the business relationship is 0.01% although that does change. The minimum corporeality required to open a Premier Plus checking account is $25. Those who have the Premier Plus checking account also can use any of Chase's in-network ATMs for complimentary and go 24-hr online banking access and online bill pay equally well every bit Chase customer service.

People who open up a Premier Plus checking business relationship also get the standard fee for using an out-of-network ATM waived for up to 4 transactions per month. Chase Premier Plus checking account holders also don't have to pay a fee on any other Hunt accounts that they concord.

The monthly service fee for a Premier Platinum account is $100 but information technology is possible to become that fee waived. And the Premier Platinum checking account comes with large perks. Yous will get all the perks that come with a Premier Plus checking account plus:

- No ATM fees, even out-of-network

- No fee for personal checks

- No fee for cashier's checks or counter checks

- No fee for debit carte du jour replacement

- No fees for returned items or bereft fund items

- No wire transfer fee

- No extended overdraft fee

- Free annual utilize of a small safety deposit box

Another benefit is priority service and 24-hr live help. You'll ever be able to accomplish an actual human being to help you manage your business relationship or answer your banking questions with a Chase Premier Platinum business relationship.

Here is a basic rundown of the types of fees charged for savings accounts, checking accounts, overdraft and more:

Savings Accounts

The basic monthly fee for a Chase saving account is $5. Still, saving business relationship fees are waived if you have a savings account that is tied to a Premier Plus or Premier Platinum checking business relationship. You can also get the saving account fees waived if you accept a minimum daily balance of $300 or more or if you have an automated repeating transfer of $25 or more than into the savings business relationship each calendar month. If you have a Hunt savings account and you are under 18 years sometime, at that place is no monthly service fee.

Checking Accounts

Chase Full Checking accounts accept a $12 monthly fee for everyone except students. Students pay a Chase monthly checking account fee of $6. Total Checking account fees tin can be waived if y'all take a daily balance of $1500 or more. You tin also get the monthly fee waived if you have more than $500 in Direct Deposits each month into the account. The third way to avert paying the monthly fee is to maintain $5000 or more in deposits or investments across several Hunt accounts.

The Chase Premier Plus checking account comes with a $25 monthly fee. Customers tin can become that waived by maintaining a daily residuum of $xv,000. The monthly fee can also be waived if y'all have a Chase first mortgage and yous are enrolled in automatic payments on that mortgage.

The monthly service fee for a Chase Premier Platinum account is also $25. That fee is waived if you maintain a daily balance of $75,000 or more than.

Chase ATM Fees

Chase doesn't charge an ATM fee if customers use any of the 16,000 network ATMs. At that place is a $2.l fee per transaction to use any ATM that isn't in the Chase network within the Usa. Using an international ATM that isn't in the Hunt network volition price $5 per withdrawal and $2.50 for a balance inquiry or to transfer money. Those are on top of any fees that the ATM possessor charges. The ATM withdrawal limit is $1000 per mean solar day.

Overdraft And Insufficient Funds Fees

Hunt overdraft fees are $34 per detail that is returned or has insufficient funds. Items that are less than $5 or overdraw the account by less than $v won't be charged the $34 fee. Up to three overdraft charges can be assessed per day. In improver to the $34 overdraft fee per detail if the account stays overdrawn for more than five days there is an additional $15 charge every v days called an extended overdraft fee.

Penalties and Withdrawal Limits

If you have a Chase savings account there are withdrawal limits you need to know about. If you lot make more than than six withdrawals from your savings account in a month, Chase will charge a $v fee, and they will also automatically change your savings account to a checking account.

Applying for an account is free and takes less than ii minutes with no touch to your credit score.

Cyberbanking services provided by The Bancorp Bank or Stride Bank, N.A., Members FDIC. The Chime Visa® Debit Bill of fare is issued by The Bancorp Banking concern or Pace Bank pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted. The Chinkle Visa® Credit Architect Card is issued past Stride Depository financial institution pursuant to a license from Visa U.South.A. Inc. and may be used everywhere Visa credit cards are accepted. Please see back of your Card for its issuing bank.

While Chinkle doesn't effect personal checkbooks to write checks, Chime Checkbook gives yous the liberty to send checks to anyone, anytime, from anywhere. Run across your issuing bank'southward Deposit Account Agreement for total Chime Checkbook details.

By clicking on some of the links in a higher place, you will leave the Chime website and exist directed to a 3rd-party website. The privacy practices of those third parties may differ from those of Chime. We recommend yous review the privacy statements of those 3rd party websites, as Chinkle is non responsible for those 3rd parties' privacy or security practices.

Information Accurate equally of March 2018

© 2013-2022 Chinkle. All Rights Reserved.

Source: https://www.chime.com/bank-fees/chase-banking-fees/

0 Response to "what do you need to open a chase checking account"

Post a Comment